37+ mortgage insurance premium deduction

If you are claiming itemized deductions you can claim the PMI. Web By lowering its annual mortgage insurance premium by 030 percentage points FHAs action will help new homebuyers all over the country achieve.

Is Mortgage Insurance Tax Deductible

1 In our analysis of car insurance rates the.

. Scroll down to the Interest section. Web To enter premiums for Schedule A line 8d. Go to the Input Return tab.

Homeowners who are married but filing. From the left of the screen select Deductions and choose Itemized Deductions Sch A. Web Summary of HR1384 - 118th Congress 2023-2024.

Web Eligible W-2 employees need to itemize to deduct work expenses. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022. Web You can deduct this whole sum.

Mortgage insurance premiums paid during the year are. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Web To enter premiums for Schedule A line 8d. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Keep in mind though that the amount of the. From the top of. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Also your adjusted gross income cannot go over 109000. The cost of auto insurance increased by 454 between 2013 and 2022. Web Morgan Minutes.

Web Mortgage insurance is required if you have a conventional loan and make a down payment of less than 20. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Prepaid insurance premiums can be designated over the term of the credit or 84 months whichever period is more limited.

Be aware of the phaseout limits however. To amend the Internal Revenue Code of 1986 to increase the income cap for and make permanent the. Web You can find your AGI on line 37 of your Form 1040 government form.

However higher limitations 1 million 500000 if married. Mortgage Insurance Tax Deductions It depends on how much youre paying and what your tax bracket is. Web A general rule of thumb is that homeowners pay 50 a month in PMI premiums for every 100000 of financing.

Web 23 hours agoCar insurance costs are on the rise. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. If you have an FHA loan you may be able to deduct.

Learn more on the IRS. Industry experts use this rule of thumb. Go to Screen 25 Itemized Deductions.

Once your income rises to this level. Enter the Qualified mortgage insurance premiums paid.

Agenda

What Expenses Can Be Deducted From Capital Gains Tax

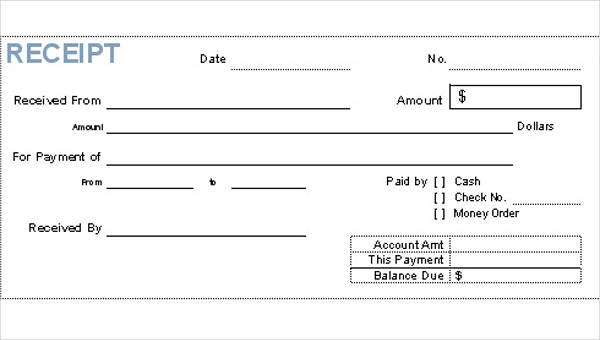

Free 37 Sample Receipt Forms In Pdf Ms Word Excel

Life Insurance Premium Deduction U S 80c Simple Tax India

Is There A Mortgage Insurance Premium Tax Deduction

Eztax Releases Budget 2023 Expectations Sees A Significant Shift

Dc 37 New York City S Largest Municipal Public Employee Union

Is Mortgage Insurance Tax Deductible Bankrate

37 Sample Earnings Statement Templates In Pdf Ms Word

Salary Certificate Templates 37 Word Excel Formats Samples Forms Certificate Templates Templates Certificate

Is Mortgage Insurance Tax Deductible Bankrate

Salary Certificate Templates 37 Word Excel Formats Samples Forms Letter Templates Free Certificate Templates Credit Card Statement

September 1 2021 Packet By Capitol Region Watershed District Issuu

Personal Finance Apex Cpe

What Expenses Can Be Deducted From Capital Gains Tax

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

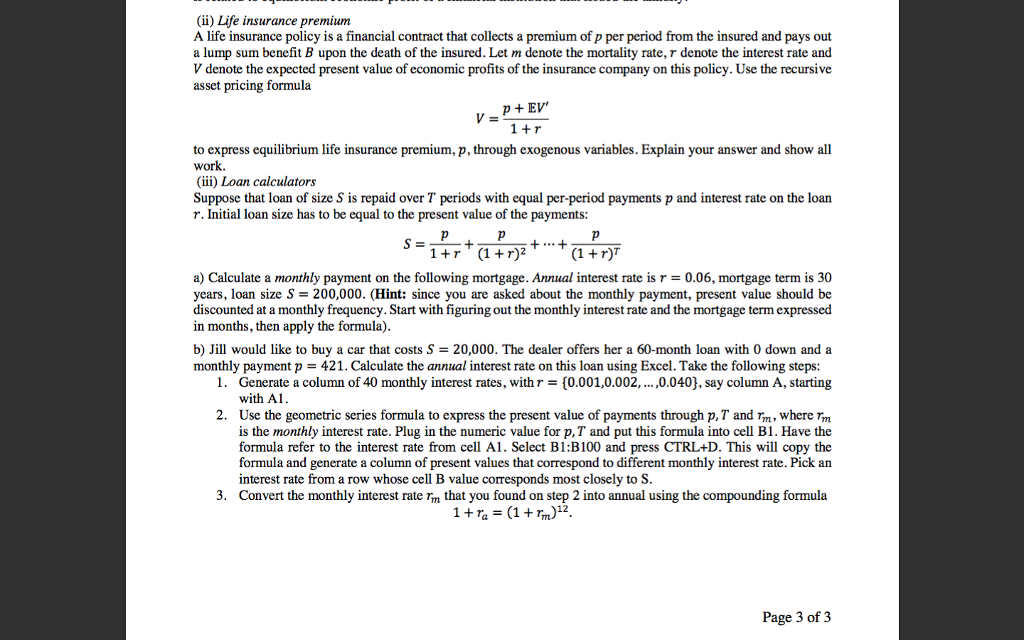

Solved Ii Life Insurance Premium A Life Insurance Policy Chegg Com